fulton county ga property tax sales

Please type the text you see in the image into the text box and submit. Atlanta GA 30303.

Fulton County Commissioners Return To Newly Improved Assembly Hall For The First Time This Year

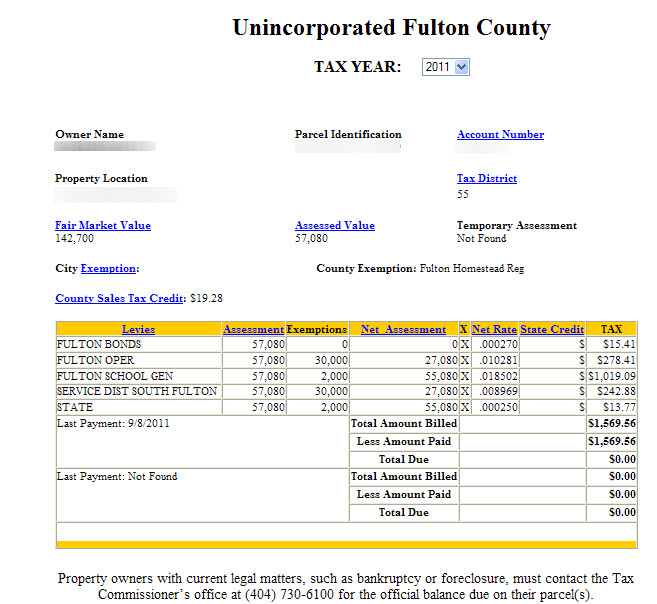

The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set.

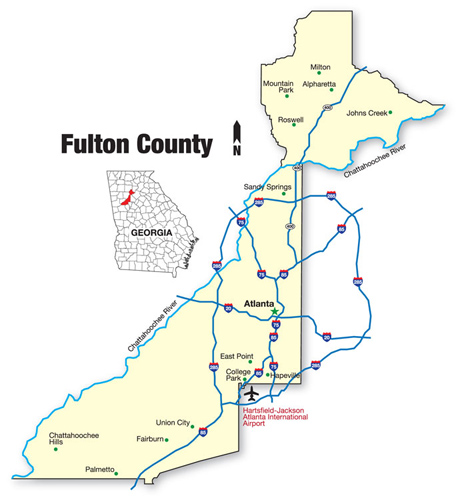

. For TDDTTY or Georgia Relay Access. Property Taxes The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. South Service Center 5600 Stonewall Tell Road Suite 224 College.

185 Central Ave 9th Floor. Infrastructure For All. Refund requests must be made within one 1 year or in the case of taxes three 3 years after the date of the payment of the tax or license fee Refer to OCGA.

Register for 1 to See All Listings Online. Due to renovations at the Fulton County Courthouse located at 136 Pryor. Alpharetta Service Center 11575 Maxwell Road Alpharetta GA 30009.

Tax Sales - Bidder Registration. Online registrations must be verified in-person between 830 AM and 945 AM on the day of the tax sale. The tax parcel dataset is used primarily in support of the Fulton County Board of Assessors mission of appraising properties and building the annual tax digest.

Fulton County Board of Assessors. North Service Center 7741 Roswell Road NE Suite 210 Atlanta GA 30350. Taxpayer Refund Request Form.

6 rows The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state. Taxpayers should obtain a general understanding of the property tax laws of Georgia that apply statewide. County Property Tax Facts Fulton On this page.

Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next business day. A tax sale is the sale of a Tax Lien by a governmental entity for unpaid property taxes by the propertys owner. The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set.

The Fulton County Board of Assessors reserves the right when circumstances warrant to take an additional 180 days pursuant to OCGA. The current total local sales tax rate in Fulton County GA is 7750. The December 2020 total local sales tax rate was also 7750.

This page contains local information about a specific county. Documents necessary to claim excess funds in Fulton County below are the instructions on submissions. Please submit no faxesemails the required documentation for review to the following address below.

Fulton County Tax Commissioner Dr. If you need reasonable accommodations due to a disability including communications in an alternative format please contact the Disability Compliance Liaison at 404612-9166. Present your photo ID when you arrive to receive your bidder ID card.

Fulton County Initiatives Fulton County Initiatives. Houses 8 days ago Fulton County Government Center 141 Pryor Street Suite 1018 Atlanta GA 30303-3487. Ad Buy Tax Delinquent Homes and Save Up to 50.

The Fulton County Sheriffs Office month of November 2019 tax sales. 48-5-311 e3B to review the appeal of assessments of property value or exemption denials. Property Taxes The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments.

Ferdinand is elected by the voters of Fulton County. 2013 and titled in this State are exempt from sales and use tax and annual ad valorem tax. The Fulton County Tax Commissioner is responsible for the collection of Property Taxes for Fulton County government Fulton County and City of Atlanta Schools the State of Georgia and the cities of Atlanta Mountain Park Sandy Springs Johns Creek and Chattahoochee Hills.

All taxes on the parcel in question must be paid in full prior to making a refund request. Please fully complete this form. Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am.

Bidder ID cards will not be issued after the tax sale is under way The information entered in the following application will be used to. Atlanta GA 30303. Fultons rate inside Atlanta is 3.

Find Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More. Tax Sales-Excess Funds Procedure Application. Fulton County Sheriffs Office.

Fulton County Board Of Equalization

Faqs Fulton County Superior Court Ga Civicengage

News Coverage Of Fulton County Development Authority By The Ajc

Faqs Fulton County Superior Court Ga Civicengage

Fulton County Schools Adopts Property Tax Rate

Fulton County Georgia Property Tax Calculator Unincorporated Millage Rate Homestead Exemptions

Fulton County Board Of Assessors

Fulton County Sends Out Annual Assessment Notices To Milton Homeowners News Milton Ga

Fulton County To Add Additional Tag Renewal Kiosks In Atlanta

Fulton County Ga Property Data Real Estate Comps Statistics Reports

Fulton County Tax Commissioner Office Greenbriar Mall

Fulton County Census Tracts By Level Of Likely Reo Investor Ownership Download Scientific Diagram

Fulton County Georgia New Energy And A New Mission Aim To Complete The Picture In Greater Metro Atlanta Site Selection Online

Why You Should Appeal Your Atlanta Property Taxes This Year And How To Do It True Square Financial Fee Only Financial Advisor In Atlanta Georgia

South Fulton County Tag Office Closed Due To Safety Protocols