child tax credit 2021 income limit

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600. Our AGI is 192000.

We expected our CTC to be 6000 with the new rule minus the.

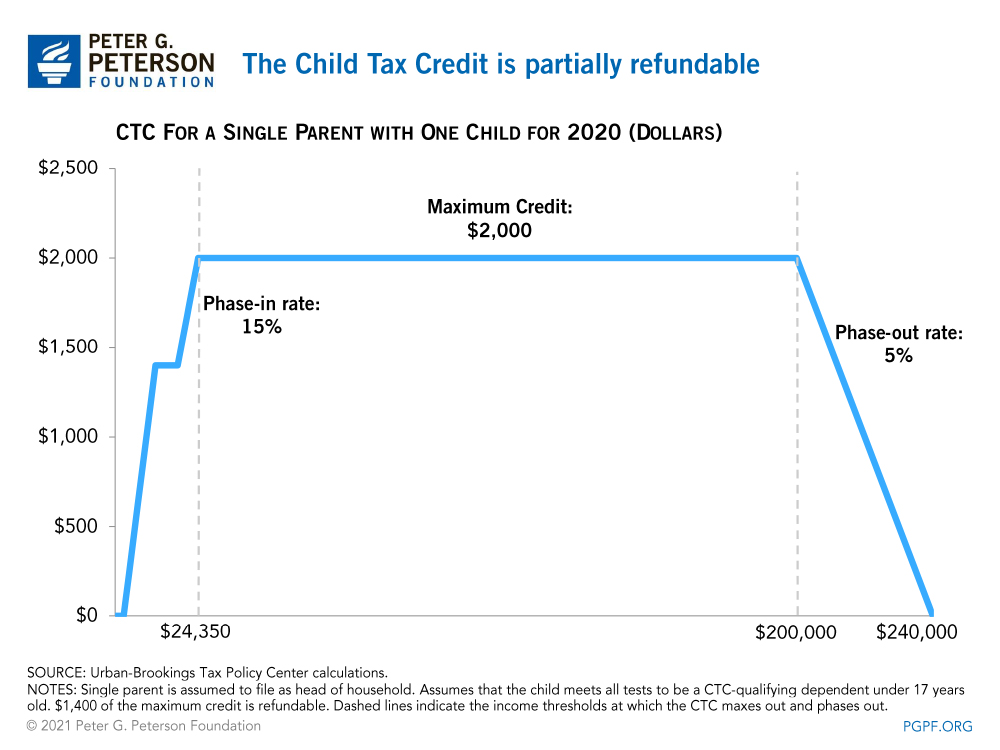

. Families making 150000 a year or less will get the full credit. The expanded credit is for tax year 2021. The Child Tax Credit CTC was set to 2000 per child for 2021 before Biden Stimulus bill ARPA update the same level as it was in 2020 and is available to taxpayers who.

We received 2100 in advanced Child Tax Credit CTC in 2021. 150000 if you are married and filing a joint. 150000 if you are married and filing a joint.

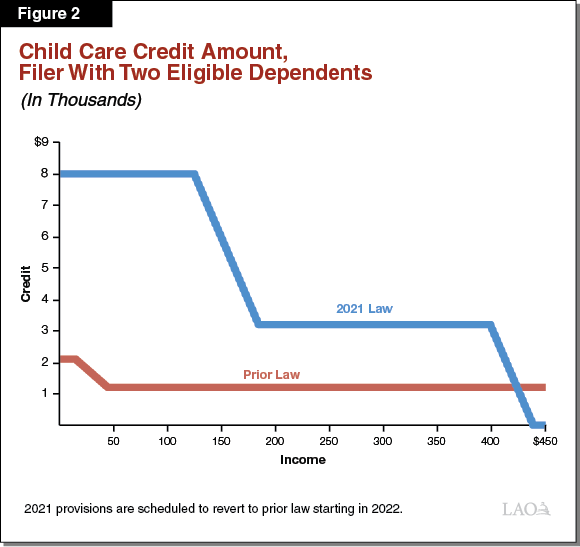

Up to 4000 for one qualifying person for example a dependent who is under age 13 who needs care up from 1050 before 2021. The credit amounts will increase for many. The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only.

The credit reverts to previous amounts in 2022. However even those with a higher gross income will still be eligible for the initial child tax credit worth 2000. The income limit for the Child Tax Credit is 75000 for single filers and 110000 for.

Our kids are 15 and 13. Tax Year 2021 Income Limits and Range of EITC Number of Qualifying Children For SingleHead of Household or Qualifying Widowed or Married Filing Separately Income. The Child Tax Credit begins to be reduced to 2000 per child if your modified AGI in 2021 exceeds.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. You do not need to have a child to be eligible to claim the Earned Income Tax Credit. Previously you were not able to get this credit for your child if they were 17.

The credit can be worth up to 2000 per child and it can be used to offset taxes owed. Families making 150000 a year or less will get the full credit. The income limit for this rate is 200000 for individuals and.

150000 if married and filing a joint return or if filing as a qualifying widow or. Most workers can claim the Earned Income Tax Credit if your earned income is less than 21430. Up to 8000 for two or more qualifying people who.

The Child Tax Credit begins to be reduced to 2000 per child if your modified adjusted gross income AGI in 2021 exceeds. The Child Tax Credit begins to be reduced to 2000 per child if your modified adjusted gross income AGI in 2021 exceeds. You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

The income limit is 75000 if youre filing single and under 150000 if youre. 150000 for a person who. Treatment in the National Income and Product Accounts NIPAs Refundable income tax.

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Tax Credit Expansions In The American Rescue Plan

Guide To 2021 Child Tax Credit Amounts Eligibility Becu

What Build Back Better Means For Families In Every State Third Way

What Is The Income Limit For The Child Tax Credit 2022 2023

Publication 596 2021 Earned Income Credit Eic Internal Revenue Service

The American Families Plan Too Many Tax Credits For Children

The Child Tax Credit The White House

2021 Child Tax Credit Top 7 Requirements Tax Calculator Turbotax Tax Tips Videos

What Is The Income Limit For The 2021 Child Tax Credit

How The 3 000 Child Tax Credit Could Affect Your Tax Bill

Verify If You Had A Baby Last Year And Didn T Get Extra Child Tax Credit Money Can You Get It By Filing Taxes 12newsnow Com

What Is The Child Tax Credit Tax Policy Center

The Child Tax Credit Research Analysis Learn More About The Ctc

Everything You Need To Know About The 2021 Child Tax Credit Storyline Financial Planning Christian Financial Advice

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service